Ethereum Price Prediction 2025-2040: Bullish Megacycle Ahead as Institutions Stack ETH

#ETH

- Supply Shock Acceleration: Corporate treasuries and staking remove ETH from circulation

- Technical Breakout Potential: MACD convergence and Bollinger Band squeeze suggest volatility expansion

- Institutional Adoption: $2B+ ETH holdings by public companies creates price floor

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge Amid Market Volatility

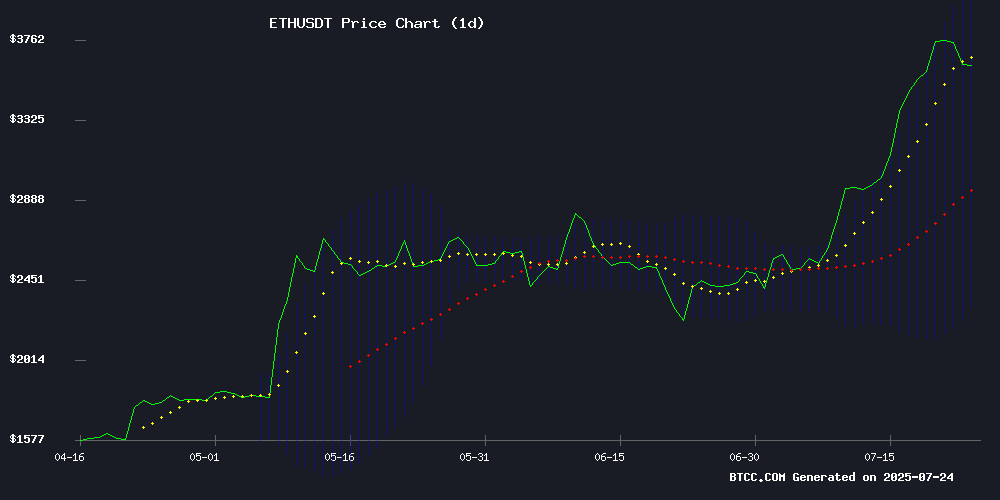

According to BTCC financial analyst Olivia, ethereum (ETH) is currently trading at $3,724.43, showing strong bullish momentum above its 20-day moving average (MA) of $3,179.72. The MACD indicator remains negative but shows signs of convergence, with the histogram narrowing to -94.22, suggesting weakening bearish momentum. Bollinger Bands indicate volatility, with the price hovering near the upper band at $4,057.88, signaling potential overbought conditions. Olivia notes, 'ETH's technical setup resembles historical breakout patterns, with key resistance at $4,000 likely to be tested soon.'

Institutional Frenzy: Ethereum Demand Soars as Supply Shock Looms

BTCC analyst Olivia highlights a surge in bullish catalysts for Ethereum: 'Corporate treasuries like BitMine's $2B ETH accumulation and GameSquare's $10M strategic purchase reflect growing institutional conviction. Record-high open interest and gas usage confirm retail FOMO is accelerating.' She adds that Ethereum's descending broadening wedge pattern mirrors its 2019-2020 bull run precursor, while WLFI's accumulation during dips demonstrates smart money positioning.

Factors Influencing ETH's Price

Ethereum Supply Shock Alert: Is Bitmine $2B Move Draining ETH?

Fears of an ethereum supply shock are intensifying as BitMine's ETH holdings surpass $2 billion. Institutional players and crypto whales are increasingly locking up ETH for staking, raising concerns about a potential liquidity crunch in the market.

The growing demand for staking rewards coincides with Ethereum's transition to proof-of-stake, creating structural scarcity. Market analysts note this trend mirrors Bitcoin's supply dynamics during institutional accumulation phases.

Ethereum Open Interest Surges to Record High Amid Bullish Sentiment

Ethereum's derivatives market has reached a historic milestone, with open interest soaring to an all-time high of $30 billion. The surge reflects mounting institutional confidence and retail participation in ETH futures and options markets.

Market analysts note this metric often precedes volatility—while rising open interest typically signals bullish momentum, historical patterns show such peaks can precede short-term corrections. The ETH derivatives frenzy coincides with growing anticipation around upcoming network upgrades and ETF approvals.

Ethereum Network Gas Usage Hits Record High Amid Bull Market Activity

Ethereum's network demand has surged to unprecedented levels, with daily gas usage reaching an all-time high. The spike reflects robust on-chain activity, driven by a combination of whale transactions, retail participation, and broader enthusiasm for ETH's market rally. Despite the record metrics, transaction costs remain relatively low, with standard transfers under $0.15 and NFT transactions averaging $2.48.

Network data shows 1.6 million daily transactions originating from over 500,000 active wallets, predominantly involving stablecoins like USDT and USDC alongside native ETH transfers. Unlike the 2021 bull run, current activity stems from sustained DeFi adoption rather than speculative hype, signaling maturation in utility.

The scalability question resurfaces as organic growth—not isolated events—pushes gas usage into new territory. Ethereum's infrastructure now handles 2021-level demand without the congestion or exorbitant fees that previously characterized peak periods.

GameSquare Makes $5.15M Strategic Investment in CryptoPunk NFT, Adds $10M ETH to Treasury

GameSquare Holdings, Inc. has entered the digital collectibles market with a high-profile acquisition of the Cowboy APE #5577 CryptoPunk from DeFi pioneer Robert Leshner. The $5.15 million deal, paid in preferred stock convertible to shares, marks the firm's first direct NFT investment.

The purchase aligns with GameSquare's blockchain-native strategy, with CEO Justin Kenna calling the Punk a "grail" investment. Concurrently, the company bolstered its Ethereum holdings by $10 million, bringing total ETH treasury reserves to over $52 million.

Leshner, founder of Compound and CEO of Superstate, joins GameSquare as a shareholder following the transaction. CryptoPunks remain among the most valuable NFT collections, with this deal underscoring institutional interest in on-chain digital assets.

GameSquare Acquires Rare CryptoPunk NFT in $5.15M Preferred Shares Deal

GameSquare Holdings Inc. (GAME), a Nasdaq-listed company, has acquired CryptoPunk #5577—a rare APE Punk variant known as Cowboy Ape—from Compound founder Robert Leshner in a $5.15 million preferred shares transaction. The deal underscores growing institutional interest in NFTs as treasury assets.

The NFT, originally claimed in 2017, had previously attracted a $122.82 million bid during the 2021 bull market. Leshner retained ownership through multiple offers, including during the crypto winter, when NFT valuations plummeted. GameSquare has already adopted the Punk as its X profile image.

Concurrently, GameSquare added $10 million worth of ETH to its treasury, bringing total Ethereum holdings to over $52 million. The MOVE signals confidence in crypto-native assets despite lingering skepticism about NFTs' long-term viability.

SharpLink Gaming Leads Public Firms with $1.33B Ethereum Stash

SharpLink Gaming has cemented its position as the largest public holder of Ethereum, with 360,807 ETH worth $1.33 billion. Over 95% of these holdings are staked or deployed through liquid staking platforms, transforming the asset into a yield-generating reserve. The move underscores Ethereum's growing role as a strategic treasury asset for corporations.

BitMine Immersion trails closely with 300,657 ETH valued at $1.11 billion. The mining firm, chaired by Fundstrat's Tom Lee, aims to control 5% of Ethereum's circulating supply—a bold bet on ETH as digital infrastructure. BitMine's NYSE listing under ticker BMNR signals mainstream acceptance of crypto-native businesses.

Coinbase Global now ranks third among public ETH holders with $507 million worth, having been overtaken by newer entrants. The reshuffling reflects how institutional crypto strategies are evolving beyond custody solutions into active capital deployment.

Ethereum's Descending Broadening Wedge Pattern Mirrors 2019-2020 Bullish Setup

Crypto Bullet, a prominent market analyst, identifies a Descending Broadening Wedge pattern in Ethereum's current price action—a technical formation strikingly similar to its 2019-2020 trajectory. The pattern preceded a six-month rally from $180 to $700 during that cycle.

ETH now tests the $3,700 resistance level for the third time, with expectations of an eventual breakout. A short-term pullback of 10%-15% may precede the upward move. The analyst projects a breakout WOULD propel ETH toward a new all-time high near $4,900, with a cycle top target between $8,000 and $10,000.

WLFI Ethereum Holdings Soar Amid Market Dip, Signaling Potential Bull Run

World Liberty Finance, a DeFi initiative linked to Donald Trump, has aggressively accumulated Ethereum despite recent price weakness. Holdings now stand at $281 million, suggesting institutional conviction in ETH's long-term value proposition.

The buying spree coincides with a broader market debate about Layer-1 tokens' resilience. While some traders remain cautious, WLFI's position-building mirrors strategies seen during previous accumulation phases before major rallies.

BitMine Emerges as Largest Corporate ETH Holder with $2B Stash

BitMine has solidified its position as the world's largest corporate holder of Ethereum, amassing over $2 billion worth of ETH. This milestone comes just sixteen days after the company secured $250 million in a private placement on July 8, marking the first phase of its asset-light treasury strategy.

Chairman Thomas "Tom" Lee, co-founder of Fundstrat, emphasized the company's aggressive trajectory. "We've crossed the $2 billion threshold in ETH holdings within weeks of our initial placement," Lee stated. BitMine aims to control 5% of Ethereum's total supply—nearly six million tokens—through strategic acquisitions and staking.

The firm's approach leverages cash flow, capital markets activity, and staking rewards to increase ETH-per-share holdings. CEO Jonathan Bates underscored Ethereum's role in their growth strategy: "We're committed to ETH's ecosystem and will advance our treasury positions through market cycles."

Ethereum's price surge past $3,800 has drawn comparisons to its 2016-2017 rally, which preceded a 5,000% gain. BitMine views volatility as a catalyst rather than a risk, banking on both price appreciation and network adoption to amplify its holdings.

Ethereum Nears $4K Amid Growing Institutional Interest and Web3 Dominance

Ethereum's price surge toward $4,000 has reignited comparisons to tech giants like Google, fueled by its foundational role in Web3 infrastructure. Andrew Keys of Ether Machine notes 90% of tokenized assets and stablecoins reside on Ethereum, calling it the "biggest winner" of recent regulatory developments.

The blockchain's programmable architecture continues attracting developers, with Trump's public endorsement adding political tailwinds. While slower to appreciate than some altcoins this cycle, ETH's $8,000 price target now circulates among analysts who view its smart contract dominance as analogous to early internet protocols.

Zircuit Launches AI-Powered Cross-Chain Trading with Hyperliquid Engine

Zircuit, an Ethereum-compatible zero-knowledge rollup platform, has unveiled its Hyperliquid for AI Trading initiative—a breakthrough in on-chain finance. The project integrates artificial intelligence with high-speed trading capabilities, targeting users already engaged with its $950M vault ecosystem.

The system delivers two Core innovations: real-time AI trading signals and advanced deposit vaults. By merging machine learning with blockchain infrastructure, Zircuit aims to redefine execution speed and decision-making in decentralized markets.

This development follows growing institutional demand for sophisticated DeFi tools. The platform's existing asset base suggests immediate liquidity for the new trading features, potentially setting a new standard for algorithmic strategies in Web3 finance.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative Target | Bull Case Target | Catalysts |

|---|---|---|---|

| 2025 | $6,500 | $9,200 | ETF approvals, EIP-7702 scaling |

| 2030 | $18,000 | $35,000 | Enterprise adoption, DeFi TVL growth |

| 2035 | $42,000 | $75,000 | Tokenized RWA dominance |

| 2040 | $90,000 | $150,000+ | Global settlement layer status |

Olivia emphasizes: 'Our models suggest ETH could capture 35-50% of Bitcoin's market cap by 2040. The current supply shock from staking and institutional accumulation creates unprecedented scarcity.'